Proving that digital marketing is critical to business strategy is a must for agencies. Fortunately, this is an easy thing to do.

The proof is in the pudding, or more accurately, in the data.

Digital marketing is fast and it’s smart. It allows clients to quickly adapt messaging, ad channels and budgets to reflect current market conditions and adjust to evolving business needs. It’s connected to real-time data. Data that helps inform vital decisions.

We all know this stuff. It’s the basic currency that clients expect and digital agencies deliver.

So what’s next?

How does an agency differentiate?

Be strategic

Digital agencies need to be strategic. To use deep research to inform their work. And if COVID-19 has taught us anything, it’s that they need to find better ways to do it faster.

No, we aren’t going to be in a constant state of global pandemic but we now see that both industries and consumers can change dramatically overnight.

But not all clients want to invest in good research and few of them want to wait. We need to be more strategic, more frequently and more quickly.

Look Like Rockstars!

Offering strategic insight to a client not only creates smarter work, but it also makes the agency look like rockstars. More importantly, we make our clients superstars with their executive peers.

There’s nothing like a CMO talking to a CFO about real-time macroeconomic trends. Having this broader industry knowledge on hand to share gets us a seat at the table.

But how do we stay on top of our markets? How can we be smart partners for our clients instead of order taking vendors?

Market Signals

The following illustrates how to use Google Trends, a free tool most have likely used, to stay on top of our respective markets and to inform messaging in a more meaningful way.

Forget about your typical off the shelf campaigns for the Labor Day sale or a new product launch. We’re talking about a real understanding of the broader industry from a strategic perspective, not just a standard competitive analysis.

We will call these “market signals.”

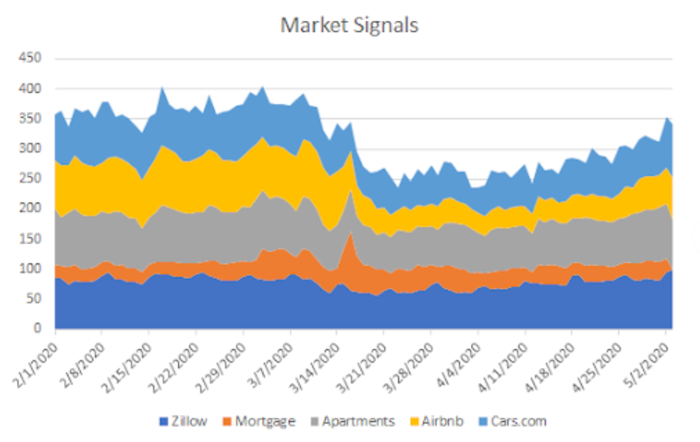

In this case, we’re trying to figure out what the data can tell us about the homebuilding industry by interpreting market signals using Google Trends.

We chose to look at the following “sister” industries:

- Zillow – a good proxy for both new and resale homes

- Mortgage – attached to home sales but worthwhile to investigate

- Apartments – a competitive and complementary industry

- AirBnB – relates to housing but in a different context

- Cars.com – kind of weird to be on the list but one of the most expensive things most people but beyond a home

Analysis

It’s no surprise to see that most industries got hammered by the global pandemic but digging deeper, we discover some interesting possibilities.

- Zillow behaved differently and it was somewhat shocking to see a relatively flat trend given that a home is the largest purchase most will ever make. Low-interest rates likely helped and seasonality could be propping numbers up here, with February through April generally among the highest months for home sales. Still a good sign, though, as homebuilding and upstream and downstream industries are critical to our economy.

- Cars.com makes sense, despite very attractive financing offers on new cars. The stock market dumped, many people were laid off and stay-at-home orders reduce vehicle needs.

- Mortgages were interesting given the historically low rates. We should have seen a spike in tune with relatively strong home sales (not accounting for a roughly two-week trough that’s hard to identify without zooming in on the graph) and the overwhelming demand for refinances (the “mortgage” search term in Google Trends included “refinance.”)

- Apartments felt the heat and dropped per the norm but then recovered. With the reality of massive and growing unemployment and delinquent rent payments, this data is hard to reconcile. Perhaps once-homeowners were looking for a place to live? It’s really important to understand this trend as apartment renters significantly contribute to first time home buyer sales.

- For AirBnB, we’re likely looking at something different. On the surface, there appears to be a recovery that would contradict the reality that people are supposed to be staying at home. With news of investors dropping their holdings from a lack of vacation demand and murmurs of layoffs at the company, it doesn’t make sense. Unless queries are boosted by users looking to refund future stays or simply to read up on the challenges the company is facing. This highlights a situation any analyst needs to look out for, when data creates noise instead of a market signal.

Who Cares?

Having this sort of discussion with your agency team and with your clients (hopefully) should not only enhance agency deliverables but, more importantly, help agency leadership make client execs look super smart, which in turn helps agencies.

Pulling, formatting and analyzing this data is a quick endeavor. And sure, some subject matter expertise to know which terms and “sister” industries to look at was required – but this something agency folks should readily know.

It’s a small-time investment that can pay off big dividends, both from a standpoint of strategic success and building smarter partnerships with agency clients.